In my last post I shared how doing customer voice research can help identify needed sales training for your team. Training salespeople is over a $ 3 billion business. However studies show 80%-90% of training does not stick and will be lost within 24 hours. How do we train adults and make it stick? In this post I will share a training process that is proven to make training stick.

Somewhere, right now as you are reading this someone is in sales training. Training occurs for many reasons. One of the most common reasons teams conduct sales training is to change behaviors and beliefs. I have been hired to train sales teams for a number of reasons. The most common is: “we want to improve our overall sales efficiency, effectiveness and increase sales profitably. We want our sales team to be more proactive,…. more hunters than farmers” Sales training is about modifying behavior so the new behavior now becomes the norm. Why does some training create a positive impact and some does not? In this post I will share a training method I use that I learned as a Karate student.

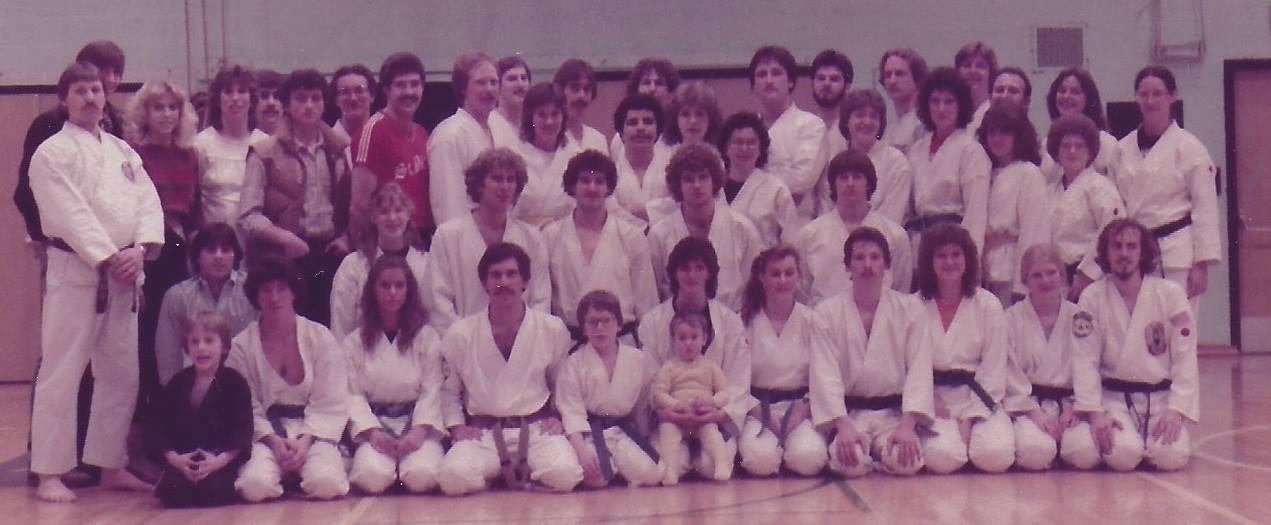

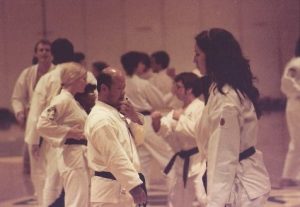

While in college at Kent State University I took a Karate class as one of my non-business electives. I enjoyed it so much I joined the local karate club and over the years became club president and helped teach Karate classes.

I started out as a white belt. A big part of that training was getting our bodies in shape for the training that would come next. We were taught basic movements that we would build on as we progresses through the other belt colors.

If you have never taken a Karate class the design methodology of how they teach is brilliant.!

Organized

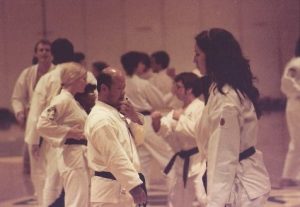

Everyone first lines up from the highest-ranking students in the front with the instructor to the lowest ranking new students in the back of the room. How the students participate and interact is designed into the training for the maximum expereince of the student.

Make us want to learn

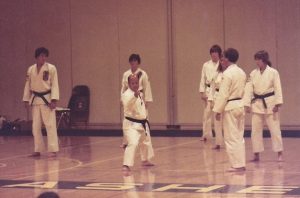

Our Instructor first tells us what we will be doing and discusses the important parts of the technique and when we might use it. Next they show us what we will be doing.

Team Alignment and consistency

As we begin the entire class is moving in unison. If you are new you can always watch people in front of you to follow along.

Practice

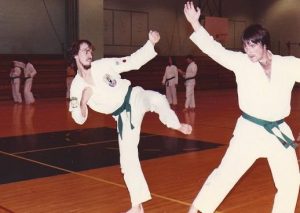

We practiced techniques over and over. While we practiced our instructor would walk around the room and observe our form.

Coaching/ demonstration

If we were not moving correctly they would give us adjustments to make and once again show us how the movement is supposed to look.

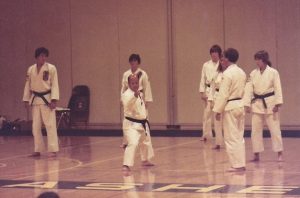

Break into small groups

About half way though the practice our instructor would break us up into groups based on skill level. The white and yellow belts would work on basic techniques and would often be led by a green belt.

Teach based skill level ( fill in gaps)

The groups were broken out by our skill level and belt rank. Our belt rank was something we were tested on to demonstrate our understanding and ability to execute a very well designed series of movements.

Show me you get it

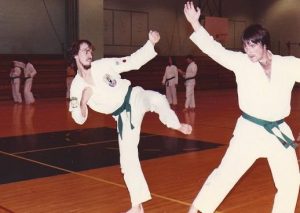

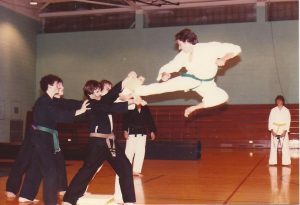

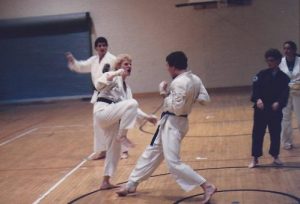

Once a student had practiced the basic movements for a specific period of time, usually months and we felt the basics created the foundation we could build on we introduced application. What is the movement you are doing designed to do? This instruction was instructor led and involved working with a partner. We practiced our blocks, punches, and kicks very slowly with a partner. Some times we were on the offensive and other times we were on the defensive side of each technique.

After foundation established build upon it

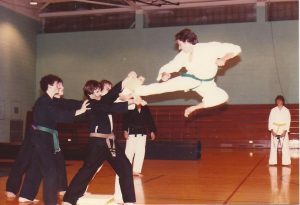

While the new students were learning the basics and how to apply them, the other ranks were learning more advanced techniques and series of movements called Kata’s . The more advanced your belt rank the more advanced your training. All training however was built on a common foundation of basic movements practiced over and over again.

Assessment to understood standards of performance

When your instructor felt you have consistently demonstrated your understanding of techniques for your belt rank you would be tested. The entire club would watch you perform what you have learned and hear the instructor’s comments and suggestions.

Importance of skill level badges

If you passed the test, and some did not, you would be awarded your new belt and the process would start all over again with new techniques demonstrated, explained, you execute them, practice, and the instructors would continuously coach you until you performed behaviors correctly without thinking to the agreed level of performance.

Introduce stress to see use of new behavior

Once you have demonstrated your ability with basic techniques and applied them successfully you will begin sparing. Sparing is a controlled fight to use the techniques you have learned in a live situation. What we are looking for at this phase is does the student apply or try to apply what we have taught? Does the student freeze, and this often happen the first time they step into the ring? Does the student continue to demonstrate control or does their emotions take over in this stressful situation?

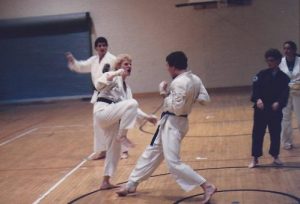

Create safe environment for coaching

When I taught it was not unusual the first time a student would move into a live sparing they would spar with me.

Training success is determined by student’s ability to demonstrate

This is not about winning but helping the student feel what it is like to apply what they have learned in a safe and coaching environment.

Ask students to teach other students

Coach

Practice

Repeat

Why all this talk about Karate and making sales training stick?

I believe all sales trainers would value taking Karate and learning how to make training stick.

The model traditional martial arts have used for centuries is brilliant.

This is the same model I have used for years when training, coaching and leading salespeople. The only thing I would add today is record your employees being trained and record your coaching in a digital format so they can take with them. As new training skills are introduced and practiced, the student can review the recordings and see their progress over time.

Using this training model helps your sales team own what you are teaching and make the behavior modifications you desire.

Teach me

Show me

Ask me to do it

Have me practice

Coach me

Teach me how to apply new behavior

Test me in a live situation, assess and coach

Follow up training with coaching

Add new skill sets once basics are consistently demonstrated

Break us up into small groups

Have clear training levels, in this case belts and everyone knows what is expected at each level

Today our sales teams need short bursts of teaching followed by how to apply and practice

If you would like your salespeople to adapt to how buyers want and need to buy today I recommend you implement or hire a sales training company that follows the above methodology.

Does your team need sales training?

What new behaviors would you like to see your team demonstrate?

Does your sales on boarding training build on a foundation of basic skills?

How does your team assess the ongoing future sales training needs of your team members?

How do you currently identify gaps in new sales employee training?

Our markets and buyers are changing how they buy. Our teams must adapt and to help them adapt we must lead training programs that result in new behaviors that meet what our markets and buyers want and need. Implement your own or hire a sales training company that follows the above methodology and your training will stick and you will realize the ROI you desire.

For more information on training adults and trends in training methods please visit some of the following web sites.

Latest training methodology

Most effective training

Effective training methodology

Creative training techniques

Sales training do’s and don’t report

Sales effectiveness training